What are Risk and Compliance Tools?

In today’s business space organizations are facing innumerable challenges which impact their financial stability, operations and reputation. Governance, risk and compliance is a methodology and structure which organizations are using to manage risks and address cyber security threats. It also helps to maintain the organization compliance posture as per the global standards, frameworks and regulations. Risk and compliance standard is achieved by means of technology and processes alignment to overall organization risk appetite and foster a culture of ethical conduct.

In today’s topic we will learn about risk and compliance in general, about risk and compliance tools, why we need risk and compliance tools and its importance.

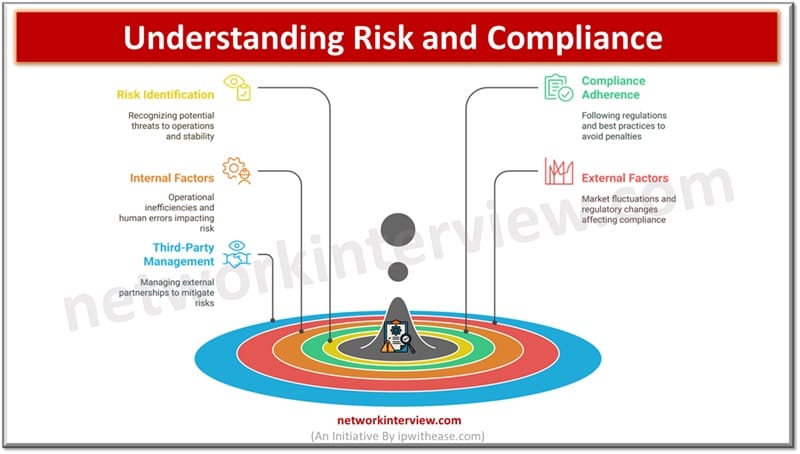

Understanding Risk and Compliance

Before we venture out to understand risk and compliance tools more in detail we need to understand the two important terminologies of ‘Risk’ and ‘Compliance’ in brief.

Risk – Potential of an event or occurrence which could negatively impact an organization’s operations, financial stability and credibility or reputation. Risks can arise due to a variety of reasons or sources such as operational inefficiencies or human errors (Internal factors), market fluctuations, regulatory changes (external factors). It is important to identify and assess the crucial impact of risk and business appetite to absorb them. In addition to this third-party risk management is an essential component of overall risk management to enhance decision making and effective compliance.

Compliance – Adherence to industry standards, global or local regulations where business operates from, and best practices form the basis for compliance. It requires establishment of policies, procedures, and controls to ensure organization operations function within the boundary of requirements. It is important to maintain legal and ethical integrity to ensure protection of an organization from legal liabilities, fines and penalties.

Why do we need Risk and Compliance Tools?

To establish a comprehensive risk and compliance framework it is important to have robust policies and procedures to enable organizations to identify, manage and mitigate risks. In addition, this risk and compliance also requires a variety of tools which help in implementing technical controls to achieve adherence to risk and compliance. Complexity of regulations and lay birth of standards post significant challenges to risk and compliance implementations. The complexity demands a high level of expertise and continuous monitoring to ensure compliance and avoid exuberant penalties or reputational damages.

There are several tools available in the market to streamline and design their risk management system and enhance compliance. Let’s look at some of these tools more in detail:

- Jirav – It is a cloud-based risk and compliance tool which provides comprehensive capabilities for risk management and helps organizations to identify, manage and mitigate risks. It has a user friendly interface, seamless collaboration and timely risk response with robust communication.

- LogicGate – It is a centralized platform to manage regulations, policies and controls. It enables organizations to be up to date and compliant on evolving requirements. It has an intuitive dashboard and reporting for real time insights into compliance allowing organizations to make data driven decisions.

- ServiceNow – It is a scalable and flexible platform with seamless integration to existing systems and processes. It has risk management ,compliance management and internal audit capabilities for a holistic view of risk and compliance posture

- SAP offering in this space has robust enterprise wide capabilities. It has a centralized platform to manage risks, controls, and compliance across enterprise. It provides seamless integration with other SAP modules to enable organizations in streamlining risk and compliance processes with real time risk data.

- Oracle offering in this space offers a panoramic feature suite – risk management, compliance management and internal audits. It is scalable to manage complex risks and compliance landscapes.